Summary

The rally in the financial markets, which started in the first quarter, continued through the second quarter. The S&P 500 Index gained over 8%, the Dow rose over 3%, and the Nasdaq was up 15%. As of June 30th, these indices are up 15.9%, 3.8%, and 31.7%, respectively.

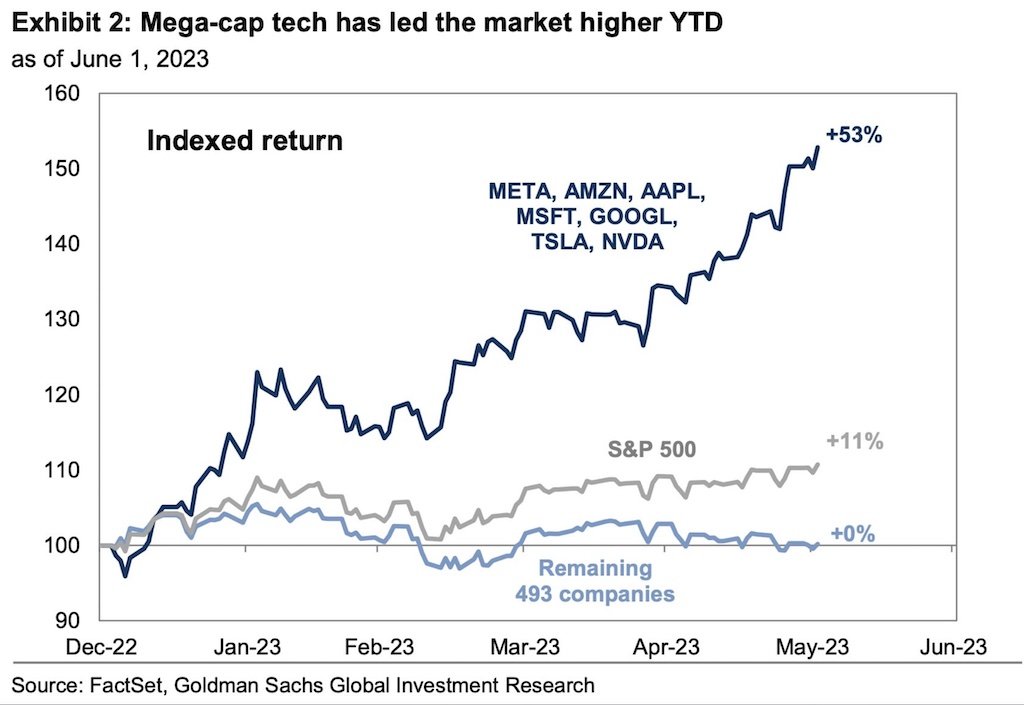

What's interesting is how much of the rally can be attributed to just seven mega-cap tech companies (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla):

Can't read this? Here's a link to a PDF of this chart.

As of June 1, the S&P 500 was up 11%. The seven companies referenced above, which I'll call the S&P 7, were up a whopping 53%. When you strip out the S&P 7, the remaining S&P 493 was flat over that period.

The outperformance of the S&P 7 is amazing but not completely unexpected. Most of the tech companies saw steep declines in 2022, so there was a good chance they would bounce back. Add an A.I.-fueled frenzy and the timing was right for a significant rally in tech stocks.

Second Quarter 2023 Numbers

The average diversified U.S. stock fund, which is a better measure of how we invest than the S&P 500 or the Dow, rose just over 6% during the second quarter. Tack on the gain of just over 6% during the first quarter, and the average diversified U.S. stock fund is up over 12% as of June 30th.

International stocks also gained, with the average diversified international stock fund up nearly 3% during the second quarter. Adding the gain from the first quarter means the average international stock fund is up over 11% for the first half of the year.

Investors, still risk-averse after pretty much everything lost money in 2022, plowed nearly $59 billion into bond funds during the second quarter. Over $44 billion was pulled out of U.S. funds and less than $1 billion made its way into international stock funds. The average intermediate-term bond fund lost just under 2.0% during the second quarter. Adding the gain from the first quarter leaves the average intermediate-term bond fund up just over 2% as of June 30th.

Returns By Broad Category

Can't read this? Here's a link to a PDF of this chart.

The chart above provides a high-level view of how the broad asset categories have fared annually from 2008 - 2022 and the first half of 2023 (the column labeled "YTD"). The category titled "Asset Alloc." refers to a 60% stock, 40% bond portfolio.

I love this chart and always look forward to seeing the updated version. Two takeaways:

Notice any patterns? If you answered "yes", we need to talk because your brain operates on a different level than mine. It's impossible to consistently predict which categories will perform best from year-to-year or month-to-month.

This chart is Exhibit A for why it's prudent to build diversified portfolios. Sadly, diversification means you're always having to say you're sorry because it's rare for every category to produce positive returns.

As far as the chart goes, the "winners" for the first half of 2023 are everything but commodities.

The "R" Word

I've had a few clients ask me about the dreaded "R" word (recession). I've seen dozens of stories predicting a recession later this year or sometime in 2024. When thinking about what's in store for investors, I try to keep in mind this quote from economist Paul Samuelson: "Economists have predicted 9 out of the last 5 recessions".

In other words, no one knows with 100% certainty when the next recession will hit. There will be another recession, but it could be later this year...or five years from now.

Rather than dwell on doom & gloom scenarios, and the many other uncertainties facing investors today, I recommend focusing on things you can control:

Stick to your financial plan. If you're a client, you already have a financial plan in place - one that takes downturns into consideration. If you're still concerned, or if something in your life has changed, you can always contact me. Not a client? Feel free to schedule an initial consultation if you want to talk about creating a financial plan.

Don't check your portfolio daily, weekly, or even monthly. Investing is a marathon, not a sprint.

Steer clear of financial "news" from sources like CNBC.

Have surplus cash to invest?* If so, just keep buying.

*Of course this comes after you've built up your emergency fund, saved for retirement, set aside money for other goals, and paid down debts.