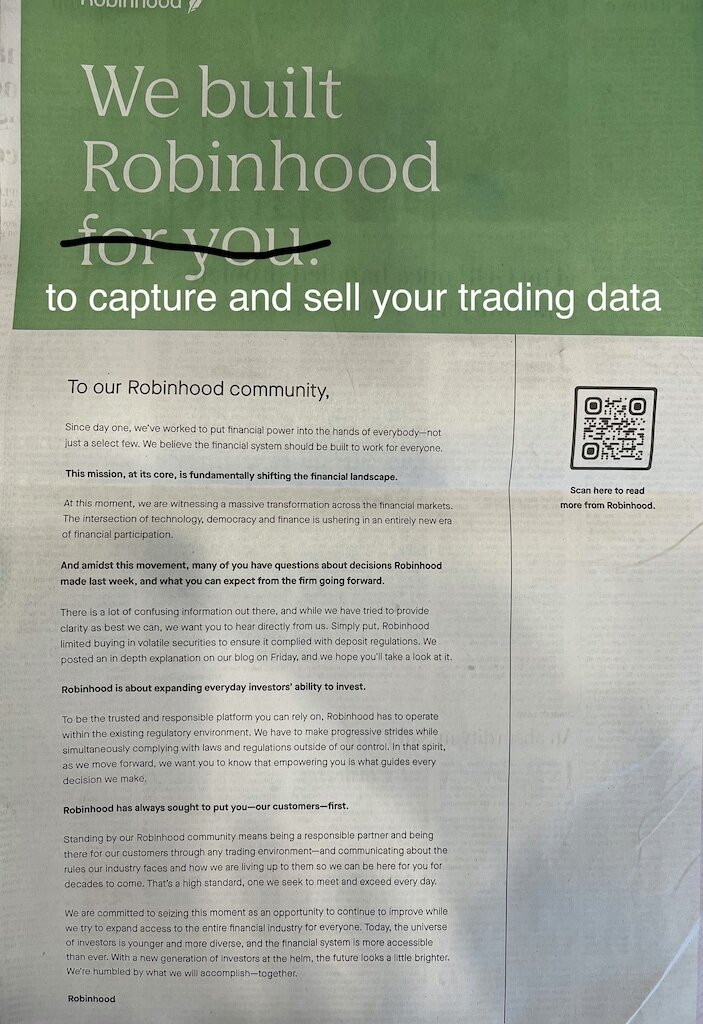

This full-page ad for Robinhood was featured in the Tuesday edition of The Washington Post. It was also misleading, so I fixed it.

If you've been paying attention to the news over the last week, you've probably noticed GameStop has been in the news a lot. The company, which sells physical video games, consoles, and accessories, was involved in something called a short squeeze. The story behind the debacle is more complicated than it appears and involves a large cast of characters, including hedge fund managers, professional traders at large institutional investment companies, securities regulators, regular Jane/Joe retail investors, and an army of angry, overzealous investors who organized on the WallStreetBets subreddit.

I'm not going to use this space to explain what happened and why; there are excellent summaries available to read online or, if you prefer audio, to listen to in podcast format. If you're interested, here are two good resources (the podcast provides an great timeline of what happened):

"The Whole Messy, Ridiculous GameStop Saga in One Sentence" by Derek Thompson of The Atlantic.

E19 of All-In with Chamath, Jason, Sacks & Friedberg: "Breaking Down Robinhood's GameStop Decision: Why did it happen and how can it be prevented in the future?". 1 hour, 26 minutes.

Again, I'm not going to summarize what happened. Instead, I want to highlight the three most important takeaways for investors.

#1: Wall Street Finds A Way

There's a scene in Jurassic Park where Dr. Ian Malcom (Jeff Goldblum) delivers the line "life finds a way". In the context of the movie the quote means that no matter what happens in life, species and nature will always find a way to reproduce and survive - even in nature's harshest conditions.

Wall Street operates in a similar manner. There are rules and regulations in place to ensure our free market system (which maybe isn't so free, but I'll get to that in takeaway #2) runs smoothly. For the most part, buying and selling of securities occurs on weekdays without too many hiccups. However, under extreme conditions, the rules can be changed in order to ensure the system continues to survive. For example, Robinhood made the surprising decision to restrict trading of shares in companies like GameStop, AMC, BlackBerry, and Nokia as shares of those companies hit new highs*.

For additional examples of Wall Street changing the rules mid-game, I recommend the book Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks.

The takeaway: Wall Street will always do what is necessary in order for the system to survive. Unfortunately, some investors may be negatively impacted when the rules are changed.

*Without getting too wonky, I believe Robinhood was forced to restrict trading of certain companies because it was undercapitalized.

#2: Zero-Commission Doesn't Mean Free

Robinhood was one of the first companies to offer zero-commission trades for stocks and ETFs. The move placed pressure on the large brokerage companies, so E*Trade, Fidelity, Schwab, and TD Ameritrade quickly followed suit.

Overall, I believe the elimination of trading fees was positive for investors. Trading fees, often a barrier to entry, have been falling for decades. Their elimination, combined with gamified trading apps like Robinhood, opened up investing to millions of people - especially younger investors.

But, as we've seen over the past week, there are downsides to zero-commission trades.

First, there's the behavioral aspect. Unburdened by trading fees, investors have been incentivized to trade more frequently. Millions of day traders, professional and amateur alike, can now buy and sell stocks and ETFs throughout the day.

Second, and most relevant in this case, is that zero-commission doesn't always mean free...and Robinhood is the poster child for "free" trading. That's because Robinhood generates revenue from high-frequency trading and payments for order flow, a practice whereby a broker receives compensation for directing orders to different parties for trade execution. For example, Robinhood earns significant revenue by directing trades and data to firms such as Citadel Securities*, who in turn use that data to front-run Robinhood's investors. This isn't illegal, but I believe it's a conflict of interest.

The takeaway: When it comes to trading, "free" doesn't always mean free. Investors should try to understand what service providers do with user data as well as how the company makes money.

*Citadel Securities was one of two firms that provided $2.75 billion to Melvin Capital, a hedge fund that was shorting GameStop and losing billions while the share price skyrocketed. An injection of cash like this is known as backstopping.

#3: Ignore FOMO

If you spend any time in r/WallStreetBets on Reddit, you'll find posts and screenshots from users bragging about their earnings from trades in companies like GameStop. Seeing other people earn money, sometimes big money, off of trading can inspire jealousy or fear of missing out (FOMO). Once the trading frenzy subsides, and you never know when that might be, someone is going to be left holding the bag, and that someone might just be you.

The takeaway: When you hear about others' investing successes, try to ignore FOMO. While some people made big money gambling on GameStop, the majority did not.

In Conclusion

To wrap up this post I'm going to drag out another pop culture reference: The Terminator. This time I'm going to paraphrase Kyle Reese:

"Wall Street can't be bargained with. It can't be reasoned with. It doesn't feel pity, or remorse, or fear. And it absolutely will not stop, ever, until you are dead."

Be careful when investing. If you don't know what you're doing I recommend educating yourself or, better yet, avoiding hot stocks that are probably too good to be true.

Or, to once again paraphrase Kyle Reese, "Come with me if you want to be a better investor".